LP Report MCJ Collective Fund I & II (Q3 2023)

In the spirit of transparency, we are publishing as much of the contents of our quarterly letter to our Limited Partners (the investors in our MCJ Collective venture funds) as allowable from a confidentiality standpoint. Here is our full public report from Q3 2023, consolidating updates for both our Fund I (“MCJ 2020 & 2022 Opportunities”) and Fund II (“MCJ 2023”). You can always view our publicly announced MCJ Collective investments on our portfolio page. We hope you enjoy the insights herein.

Quick Fundraising Update: MCJ 2023 Final Close is February 14th, 2024

MCJ 2023 is currently more than $72M in commitments.

We believe the fund will ultimately end up sized between $75M and $100M, a range at which we will be empowered to execute our full strategy.

Over the last few weeks, we welcomed new family offices, RIAs, and strategic individuals into the fund and have multiple corporate strategic LPs in final diligence.

As we are in late-stage diligence with several large prospects, we have decided to utilize our discretion to hold final close in early Q1 to allow for completion of their work.

Therefore, we are now setting a final close date for February 14th, 2024.

For those of you yet to complete your onboarding process, we will be sending reminders over the coming weeks.

For your reference, here’s the latest deck.

Asks From MCJ

Thanks to the invitation by a new MCJ LP, we recently joined the Toniic community investment platform and our profile is now live on their system. If you are a Toniic member, please review us on the Toniic portal and feel free to recommend us.

The Power of the Flywheel

MCJ wouldn’t exist without the magic of the content/community/capital flywheel that we created organically over the last five years. If we continue to do it right, the bigger we get, the faster the flywheel spins, the more value we create in each pillar, and the more defensible our position becomes. The network – and our ability to convene it– is at the heart of what we do well and what makes us special.

To that end – in addition to the 50+ digital and IRL events we’ve supported for the MCJ member community this year – we’ve also hosted a series of small dinners across the country with a mix of current LPs, potential LPs, portfolio founders, frequent co-investors, and other decarb luminary friends of the firm. These events have been incredibly energizing, and we’ve gotten great feedback from attendees. Many connections have been made at these dinners and we’ve had several new LPs cite having witnessed the power of our convening ability as the key element that convinced them to make a commitment to MCJ.

We believe that continuing to emphasize expansion of our network, the caliber of the individuals and organizations within it, and our ability to efficiently make mutually beneficial matches, will yield important benefits: increasing our dealflow, enhancing our ability to diligence opportunities, and powering-up the ability to punch above our weight class with post-investment support.

We also believe it will open the door to additional business models over time. And while we will be disciplined and focused, we sense there are adjacent opportunities that can give us more resources to feed the flywheel while simultaneously strengthening the core flywheel.

Examples of the MCJ Flywheel in Action

Despite a slower hiring market, we helped make over 40 introductions (an uptick from Q2!) to 18 very actively hiring portfolio companies.

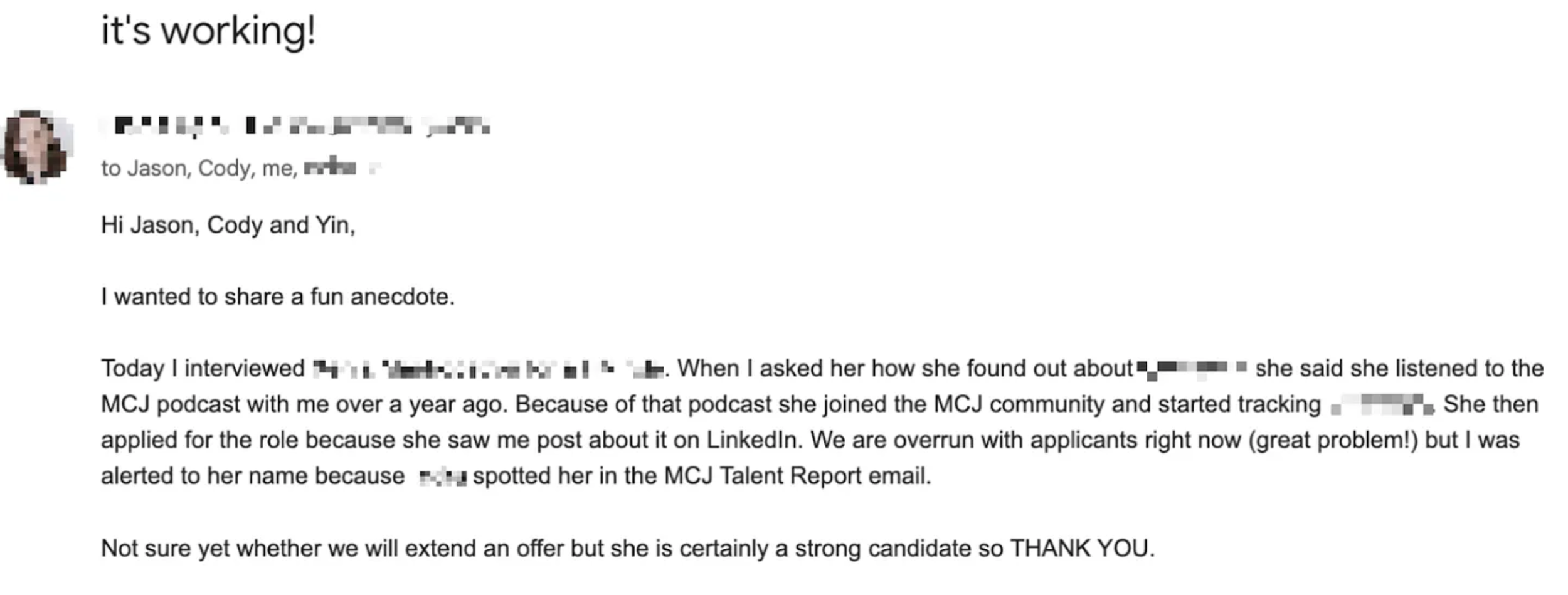

A few weeks ago we got an exciting email from a portfolio company COO with the subject line “It’s working!” We’ll let the email do the talking.

And it’s not just hiring. We made an introduction between a corporate executive who was an MCJ pod guest and one of our portfolio companies.

And of course the magic of the MCJ flywheel helps immensely with deal sourcing.

Priorities Post-Fundraise

Deployment! While in no rush, we’re excited to get back to deployment in earnest, as well as explore other opportunities that are noted below.

Future of the Flywheel: We will be undergoing a series of strategy sessions to map out the future of the core flywheel across content and community, as well as to plan how to better integrate our LPs into the MCJ ecosystem in ways that are mutually beneficial.

Annual General Meeting: We are excited to begin working on our first MCJ Annual General Meeting (AGM) and look forward to sharing our perspective and getting your thoughts and feedback.

Adjacencies: We have a short list of strategically aligned opportunities to explore, including inbound interest in forming a FOAK (First-of-a-Kind) fund, starting a talent business, and others we feel will help us build a durable and impactful future for MCJ.

Staffing: Appropriate to our budget, we will determine the talent needed to support the various activities we have underway and in consideration.

Parting Words

Our fundraising efforts over this year have provided a tremendous learning experience, especially in the face of such challenging economic conditions. This process has not only helped us refine our ability to tell our story, but has also strengthened the story itself. It has compelled us to thoroughly examine and refine our strategy and approach and to make sure we build a solid foundation for our fund family and beyond.

We have never worked harder in our careers, but at the same time, we’ve never had more fun professionally. We are deeply grateful for the opportunity to blend impact with profit, and we aspire to build MCJ into an enduring firm that will last for decades to come.

Thank you for your belief, trust, and partnership.

With gratitude,

Jason, Thai, Yin, Cody, and David

Portfolio Updates

Heirloom announced via The Wall Street Journal that Microsoft agreed to purchase credits for up to 315,000 metric tons of carbon removal over the next decade. This purchase is one of the largest carbon removal credits to date. In addition, the company announced the grand unveiling of its first commercial DAC plant in Tracy, California. U.S. Secretary of Energy Jennifer Granholm and other leaders recently toured the new commercial facility — the first in the U.S. — and attended the ribbon cutting ceremony. Finally, it was announced that Frontier would pay Heirloom $26.6M to remove 26,900 tons of CO2 by 2030 from its next commercial facility.

Leap raises $12MM in a round led by Standard Investments with participation by DNV Ventures and Sustainable Future Ventures as well as existing investors, including Union Square Ventures, Congruent Ventures and National Grid Partners.

Air Company announced a partnership with Air Canada to help the air carrier decarbonize through Air Company’s sustainable aviation fuel (SAF). Air Company has already partnered with JetBlue (JBLU.O), Virgin Atlantic and Boom Supersonic, which have collectively agreed to purchase more than one billion gallons of the fuel. The company’s SAF was also written up in Fast Company.

Twelve announced that it has broken ground on its new commercial-scale plant, at Moses Lake in Washington State, where it will scale production of its SAF. News of this was featured in Fast Company and Axios.

BasiGo was featured in a TechCrunch article reporting on EV growth in Kenya. In addition, the company announced it is the recipient of a USAID grant that will support pilot testing and scale up of its electric buses in Rwanda.

Kodama Systems was featured in Forbes which details how the company’s tree-burying operation is helping abate the release of CO2 from decaying trees.

Mill was written up in TechCrunch where its product was reviewed. It was also featured in Time’s list of “The Best Innovations of 2023.”

Phoenix Tailings announced a strategic financing round to fund its expansion and production of minerals such as Neodymium, Dysprosium, and Terbium.

Yard Stick announced its $10.6MM Series A, which was led by Toyota Ventures Climate Fund.

Lightship was featured in Bloomberg and Men's Journal, which both profiled the company’s electrified travel trailer. You can watch a review of the company’s L1 trailer here.

Opna (FKA SALT Global) announced its $6.5MM seed funding, which was led by Atomico.

Sublime Systems announced that it had received ASTM Certification for its low-carbon cement. This designation certifies that Sublime’s cement meets or exceeds U.S. and international building codes and performs at a standard opening in up for broad industry adoption. You can learn more about this in a recent story on Sublimegi produced by NPR’s Boston affiliate. The company was also recently featured in the MIT Technology Review’s list of “2023 Climate Tech Companies To Watch.”

Pachama announced LATAM e-commerce company Mercado Libre had purchased carbon forestry offsets that now total $23.7MM.

Bolt announced it had raised $20MM in new financing from Union Square Ventures, Prime Venture Partners and ITIGO Funds, among others.

Moment Energy announced that it is the first North American company to receive certification for the collection, testing, storing and manufacturing processes that go into taking used electric vehicle batteries and repurposing them into stationary energy storage systems.

Enode & David Energy announced their partnership. Through its API that connects energy devices like EVs and thermostats, Enode is helping David Energy optimize the energy use of its commercial and residential customers.

Nitricity announced the commissioning of their next generation pilot system that will support international food grower Olam Food Ingredients’ cultivation of almond trees, using low-GHG fertilizer.

Opna and Overstory were featured in Business Insider’s list of “...53 most promising climate tech startups of 2023…”

Living Carbon was profiled in an article by The Guardian, titled “Could superpowered plants be the heroes of the climate crisis?”

Artyc announced the launch of its Medstow Mini, a sustainable medical cold-chain solution for at-home diagnostics. In addition, it shared that it’s partnering with Tasso Inc., the leading provider of patient-centric clinical-grade blood collection solutions.

Odyssey Energy Solutions announced that it has partnered with I&M Bank, one of the leading financial institutions in East Africa, to accelerate the adoption of distributed renewable energy projects in the region.

Overstory announced that it has raised a $14MM Series A, led by B Capital with participation from The Nature Conservancy. TechCrunch recently published a profile on the company.

Crusoe announced it has raised $200MM to finance the expansion of its cloud services business.

Quilt announced it’s partnering with several leading HVAC installation companies.

Airloom came out of stealth and announced its new CEO Neal Rickner, former COO of Makani who met Airloom via MCJ.

AMP Robotics was featured in a recent WSJ article detailing how it’s helping recyclers facing rising costs and worker shortages.

Noya was featured in MIT News (CEO Josh Santos is a 2014 alumnus)

Disclaimers

These materials do not purport to be all-inclusive or to contain all the information that a prospective investor may desire in investigating the MCJ 2023, LP or any parallel fund thereto (collectively, the “Fund”). These materials are merely for preliminary discussion only and may not be relied upon for making any investment decision with respect to the Fund. Rather, prospective investors should rely upon the Fund’s definitive agreement of limited partnership and their own independent investigation of the Fund. In the event that any of the terms of this presentation are inconsistent with or contrary to the agreement of limited partnership, such agreement shall control. The limited partner interests in the Fund have not been registered under the United States Securities Act of 1933, as amended, or under any applicable state securities laws, nor have such limited partner interests been approved or disapproved by the United States Securities and Exchange Commission (the “SEC”) or the securities regulatory authority of any state or other jurisdiction. Neither the SEC nor any commissioner of any such state authority or other jurisdiction has passed upon the accuracy or adequacy of this presentation, and any representation to the contrary is unlawful.

This presentation does not constitute an offer to sell or a solicitation of interest to purchase any securities or investment advisory services in any state or in any other jurisdiction in which such offer or solicitation is not authorized. The case studies and the companies (including sample investments) profiled or discussed in certain sections of this presentation represent a subset of the firm’s prior investments and may not be representative of the firm’s investment experience or performance as whole. Please refer to the materials in the data room for details regarding the full investment performance of the firm. While all the information prepared in this document is believed to be accurate, the Fund and its affiliates make no representation or warranty as to the completeness or accuracy of the information in this document and accepts no responsibility.

An investment in the Fund is speculative and involves a high degree of risk. Opportunities for withdrawal and transferability of interests are restricted, so investors may not have access to capital when it is needed. There is no secondary market for the interests, and none is expected to develop. An investor should not make an investment unless it is prepared to lose all or a substantial portion of its investment. The fees and expenses charged in connection with this investment may be higher than the fees and expenses of other investment alternatives and may offset profits. Nothing presented herein is intended to constitute investment advice, and no investment decision should be made based on any information provided herein.

Past performance is not indicative of future results. Prospective investors should carefully conduct their own investigation of the Fund before making an investment. Past performance is not necessarily indicative of future results, and there can be no assurance that the Fund will achieve comparable results or that the Fund will be able to implement its investment strategy or achieve its investment objectives.

Certain performance data reported herein reflects gross returns. Management fees, carried interest, taxes, transaction costs and other expenses associated with the investments are not included in such gross performance data, and such amounts in the aggregate are expected to be substantial and would reduce the returns of fund investors.