Energetic Capital

Our Investment in Energetic Capital

Widely considered the tip of the spear of the renewable energy transition, solar energy has benefited from market forces and technological advances that have materially reduced the cost of installation and spurred its deployment. According to MIT News, improvements in the efficiency of photovoltaic modules and global economies of scale in their production are two major reasons solar energy has fallen steeply down the cost curve and, as a result, experienced a surge in adoption. Government policies have also been a boon to the solar industry, with the Biden Administration’s proposal to source 45% of U.S. energy from solar (from a current share of 4%) by 2050 serving as the latest example.

In spite of solar energy’s overall growth and the continuing tailwinds driving it, penetration in the commercial & industrial (C&I) market continues to lag behind residential markets. The primary reason for this is that commercial installers have poor financing options, due in large part to the absence of a standard credit score. An estimated 90% of organizations are unable to deploy solar projects because their credit is unrated or deemed below investment grade, which results in fewer lenders underwriting prospective C&I solar projects due to perceptions of heightened default risk.

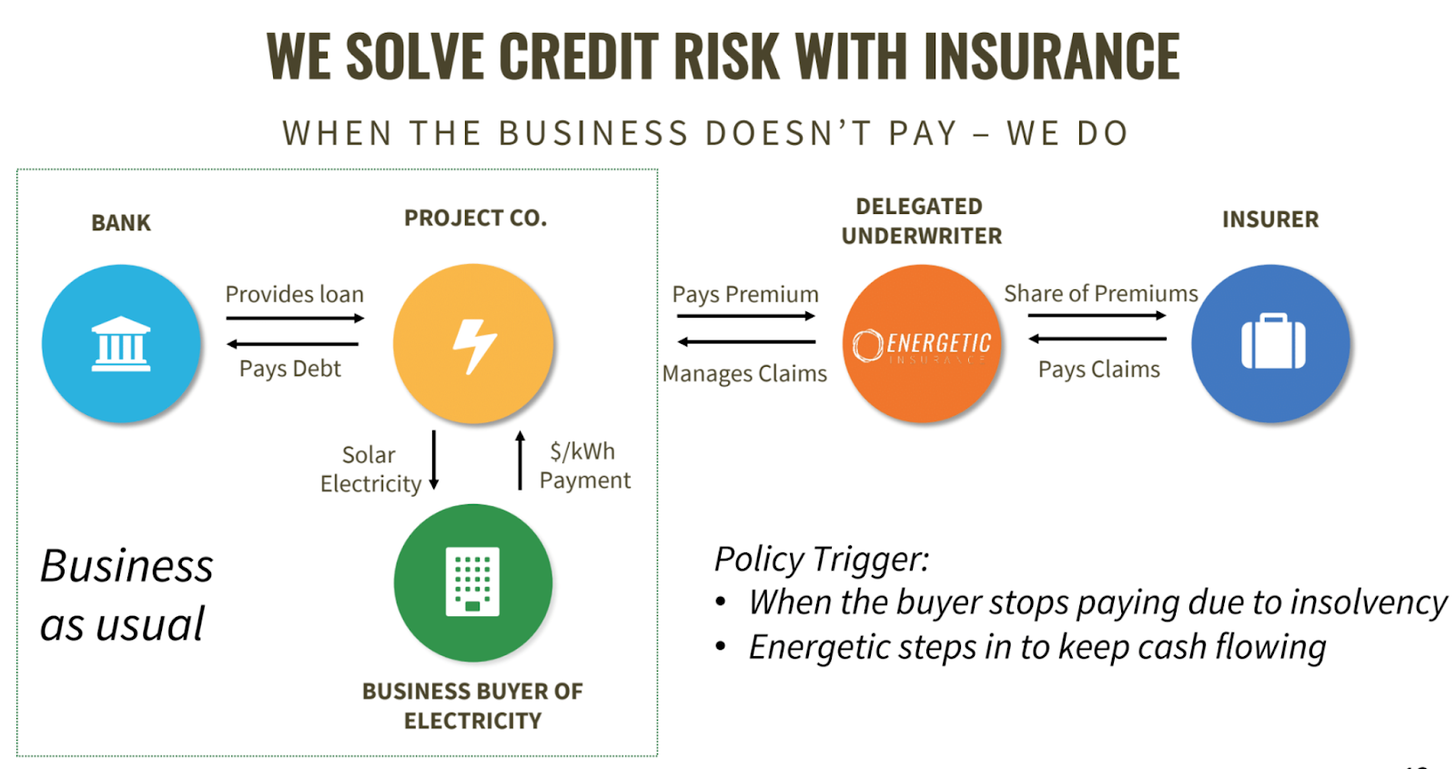

Energetic Capital, a Boston-based company enabling more organizations to access solar energy projects, is addressing the underwriting risk that hinders C&I from obtaining financing for solar installation. It does this by providing developers seeking financing for C&I projects with “trade credit insurance,” which guarantees loan repayment in the event the organization faces insolvency or bankruptcy. Energetic leverages a full-suite of software tools to model risk and manage insurance claims. Energetic’s co-founder & President, Jeff McAulay sat down with Jason during an MCJ podcast interview over the summer and shared the company’s story and mission. We’re pleased to announce our investment in Energetic, as the team — which includes co-founder & CEO James Bowen — executes its vision of applying modern finance tools and technology to spur renewable energy deployment.

Improvements in the efficiency of photovoltaic modules and expanding economies of scale in manufacturing have led to a durable cost decline in solar energy.

Commercial solar installation has been uneven but has steadily grown over the past decade. Onsite solar’s share within the commercial market still remains very small.

The gap between solar deployment in the residential market and the commercial market has widened over the past decade.

Energetic offers protection against default by the “Business Buyer,” allowing the “Project Co.” to mitigate risk and access financing from the “Bank.”

What is Energetic?

Operating at the intersection of climate, insurance, and FinTech, Energetic enables more C&I organizations to access onsite solar energy by ensuring project developers have greater access to financing. Through its EneRate Credit Cover® product, Energetic de-risks the underwriting opportunity of C&I solar projects by guaranteeing payment to lenders in the event of an organization’s default. Serving as a Managing General Underwriter (MGU), Energetic is authorized to underwrite policies on behalf of the insurance carrier with whom it partners as well perform a range of activities of a typical insurance company.

Energetic’s platform supports a full-suite of underwriting tools.

Energetic makes money by receiving a percentage of the insurance premium, in exchange for the company’s work to underwrite and price the risk on behalf of its partnering insurance carriers. Since Energetic gets paid based on the size of each deal rather than a typical SaaS fee, its top-line revenue grows as it serves more and larger C&I developers. Notwithstanding, the company aims to keep policy costs affordable, allowing more organizations to access solar projects.

Why did we invest?

Compelling Founder-Market Fit

Energetic founders, James Bowen and Jeff McAulay, both have robust backgrounds in the renewable energy sector. Prior to founding Energetic, James co-founded Vertex Energia, a developer and investor in renewable energy projects, and Jeff spent several years at EnerNOC, driving partnership strategy in solar, storage, and distributed energy resources. Their relationship spans a decade, in which they’ve collaborated multiple times in the realm of energy and entrepreneurship. And a fun fact is that they were fellow co-working space tenants of Jason’s prior to the pandemic.

Impressive Market Traction

Since its founding in 2017, Energetic has achieved impressive traction towards its mission of helping project developers deploy solar installations at C&I sites. Backed by one of the world’s largest reinsurers, SCOR SE, Energetic has insured more than 160 sites, amounting to over $70MM in insured value. The projects it insures cover 12 U.S. states and the company plans to expand overseas in the not too distant future.

With its latest round of funding, we believe that Energetic is well-positioned to expand on its value proposition, paving the way for more commercial and industrial facilities transitioning to clean renewable solar energy.