Scoot Science

Our Investment in Scoot Science

Making climate risk manageable, insurable, and investable for aquaculture

Fish, an occasional meal for some, is a primary staple for many across the world. According to the United Nations’ Food and Agriculture Organization, fish makes up 17 percent of the global population’s intake of animal protein and as much as 70 percent for those living in coastal or island areas. However, with oceans absorbing 93 percent of the heat trapped by greenhouse gases, climate change has imperiled the world’s supply of fish and the consumers and aquaculture industry that rely on it. Rising sea temperatures have led to mass migrations of fish from inlying areas of the oceans to the colder waters near the poles. Moreover, it has created conditions in which algae super blooms have become more commonplace, resulting in the die-off of farm-raised fish. As a result, aquaculture operators suffer 10 - 15% fish mortality rates and, as occurred with the “red tide” event in Chile in 2016, the industry has seen losses north of $800 million in as little as two months. This worsening threat has rendered the $60B marine aquaculture industry — and the peoples and food systems that depend on it — highly vulnerable to the climate crisis.

SeaState provides forecasting of ocean conditions, enabling aquaculture operators to adapt to hazards to their fisheries.

Addressing both the operational and financial hazards faced by the aquaculture industry, Scoot Science, based in Santa Cruz, California, is making ocean-based aquaculture manageable, insurable, and investable. Through its high-resolution data platform, the company provides fish farmers, and the financial institutions that invest in and lend to them, with visibility into ocean threats that endanger fish stock. With real-time monitoring and forecasting, operators can take measures to safeguard their business more effectively. In addition, based on the larger set of ocean data the company is assembling, it’s creating insurance products and investment tools that more accurately model and price risk. The benefit is that the aquaculture industry, amid growing climate-induced hazards, has access to financing and can continue to thrive. We’re excited to announce our investment in Scoot Science, founded by an exceptional team of ocean scientists and climate insurance experts, as it enables the aquaculture industry to adapt to the worsening effects of climate change.

What is Scoot Science?

Scoot Science helps aquaculture operators manage climate-related risk to their business by providing both insights to mitigate threats as well as access to bespoke insurance products and financing. Its initial product, SeaState, is an ocean data platform for fish farmers that unifies discrete sensor data from their fish pens with external ocean analytics. With SeaState, operators benefit from real-time threat monitoring and alerts to hazardous events, such as algae blooms, low oxygen, and temperature changes.

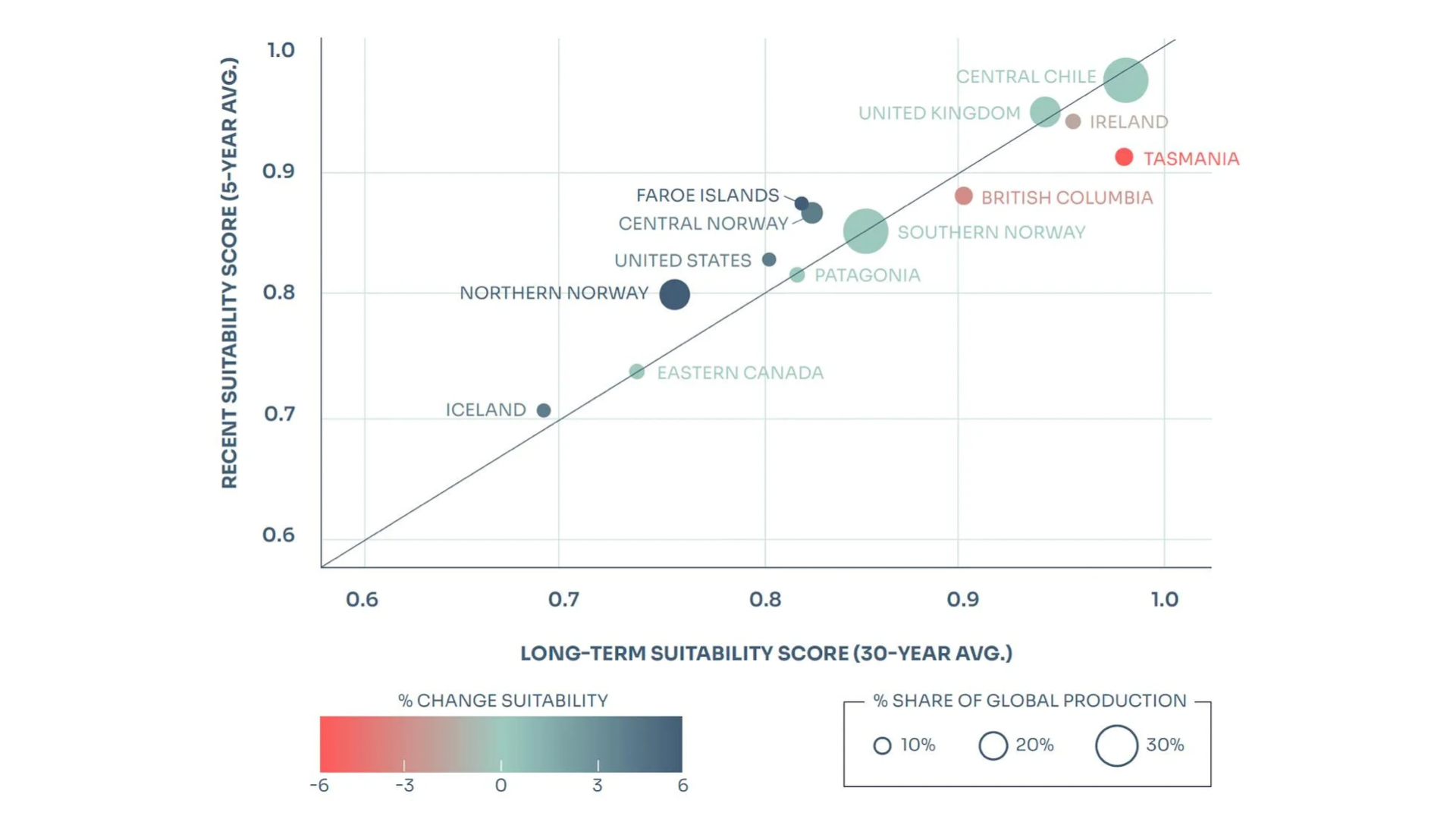

After observing that access to (re)insurance and financing is a major challenge for its aquaculture customers, Scoot Science launched SeaVest. Based on a proprietary risk model that captures historical data of the salmon farming industry and ocean trends, this software-based finance tool is intended to unlock capital and enable underwriting for the aquaculture sector. SeaVest provides institutional capital (e.g. private equity, banks, etc.) and (re)insurers with granular data on over 3,500 specific salmon sites and their past and forecasted performance. Each salmon production site is graded on its suitability and sustainability for farming fish.

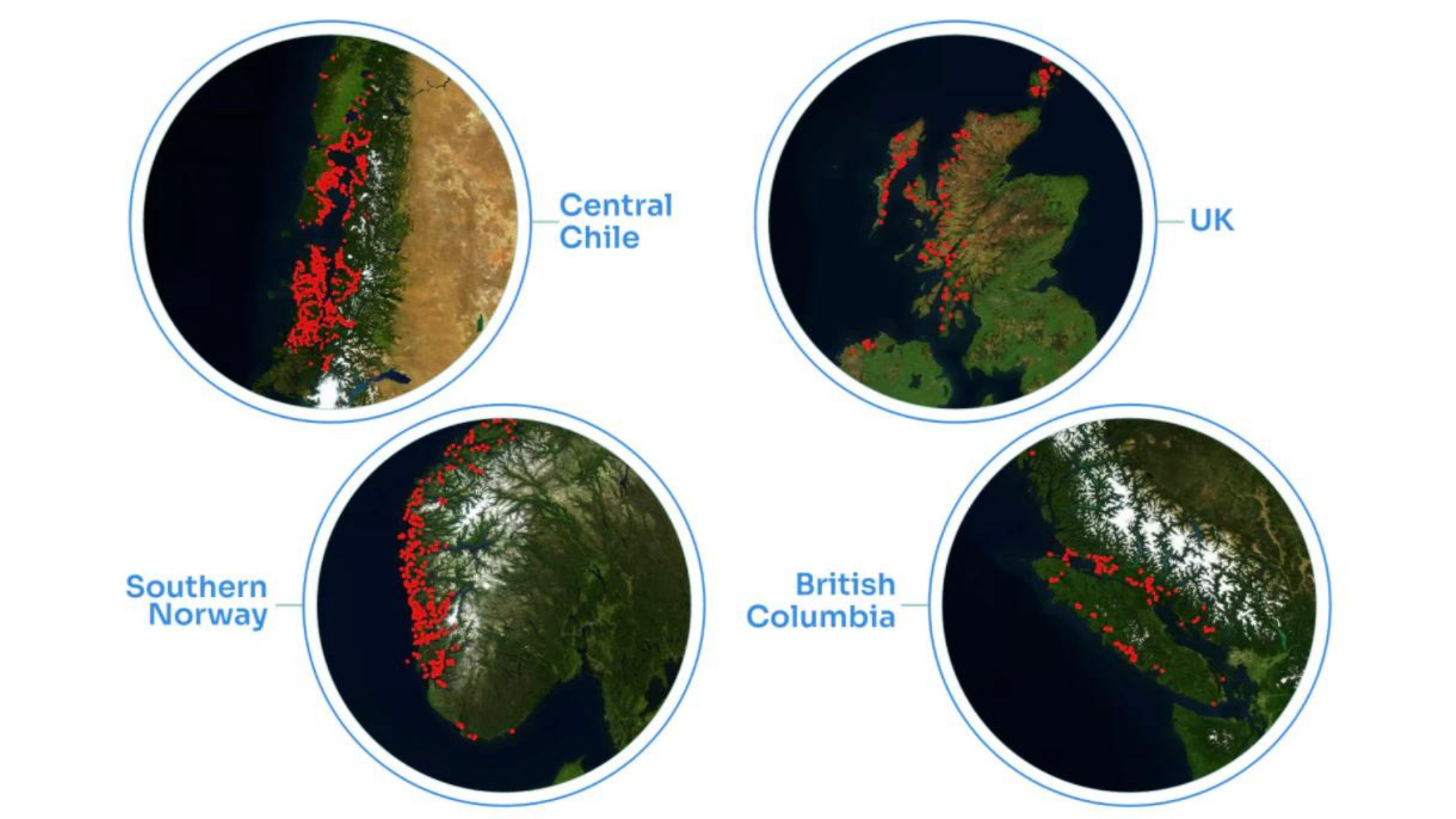

Maps of farm sites in four salmon producing regions. SeaVest includes a total of 3,704 global farm sites.

Why did we invest?

Compelling Founder-Market Fit

Scoot Science co-founders, Jonathan LaRiviere and Evan Goodwin, have deep academic backgrounds in the ocean sciences and a keen understanding of the climatological risk factors that threaten the aquaculture industry. The addition of Grant Cavanaugh, the company’s Chief Investment Officer who hails from climate-reinsurer Nephila, complements the team and provides it with the actuarial acumen needed to build an insurance business. Collectively, the team is equipped with the critical technical and industry talent needed to execute its vision.

Enabling Adaptation of a Key Industry

Helping aquaculture manage operational danger, mitigate financial exposure, and access capital, Scoot Science delivers a three-pronged value proposition. By leveraging the company’s offerings, the aquaculture industry is better able to navigate the threats caused by the climate crisis.

While the outlook for ocean warming continues to worsen, Scoot Science is deploying technologies and products that will ensure the aquaculture sector, on which the world depends, can adapt. We believe that the company is positioned to become an integral solution to ensuring the resilience of aquaculture as a major pillar of the global food system.